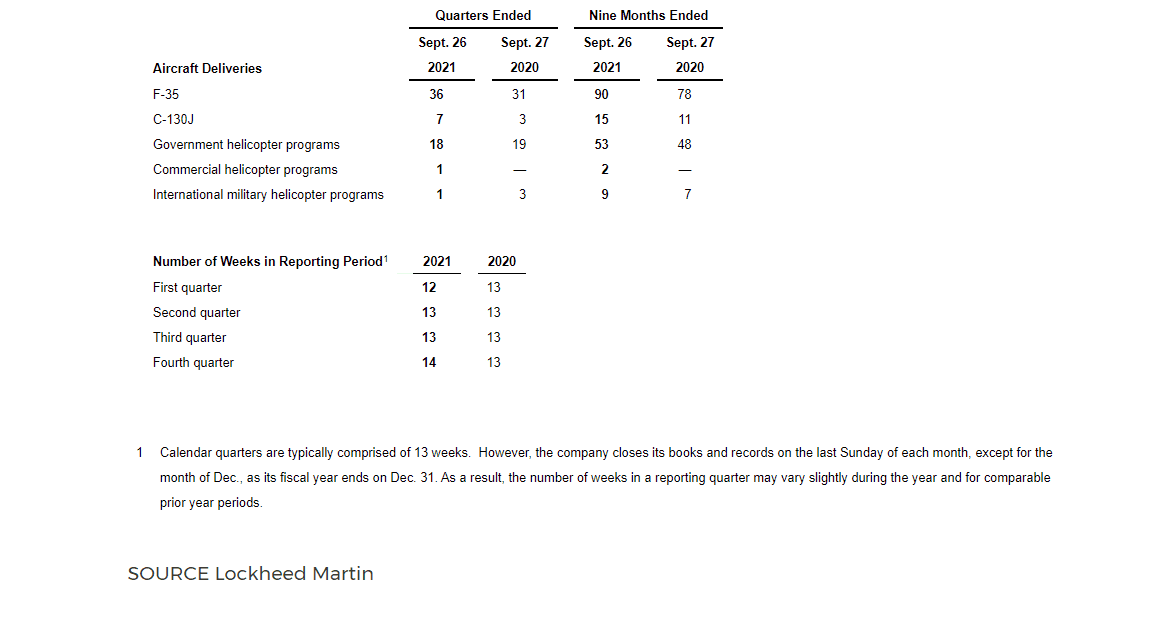

Lockheed Martin Corporation today reported third-quarter 2021 net sales of $16.0 billion, compared to $16.5 billion in the third quarter of 2020. Net earnings from continuing operations in the third quarter of 2021 were $614 million, or $2.21 per share, compared to $1.8 billion, or $6.25 per share, in the third quarter of 2020. Cash from operations was $1.9 billion in the third quarter of 2021 and 2020.

World"s biggest defence and aviation company Lockheed Martin announced the financial results of the third quarter in 2021. The revues and production indicates a rise since the Covid-19 outbreak but is behind the prior outbreak.

"During the third quarter, the men and women of Lockheed Martin continued to deliver essential products and capabilities for domestic and allied national defence and pioneering civil space endeavours," said Lockheed Martin Chairman, President and CEO James Taiclet. "At the same time, we continued to advance the state of the art and innovation across key technologies, including Future Vertical Lift, Integrated Air and Missile Defence, hypersonic weapon systems, next-generation satellites, and many others.

"In addition, we have recently undertaken a reassessment of our five-year business plan given recent external and programmatic events. Our conclusions, which are reflected in our updated 2021 guidance and subsequent trend information, reflect continuing strong cash flow generation but a slight reduction in revenue in 2022 and roughly flat to low-single-digit growth rates in both revenue and segment operating profit over the next few years, with increasing growth opportunities in the years that follow.

"Consequently, we are adjusting our capital allocation strategy with two major objectives. First, to expand further our robust reinvestment in the company to serve our customers" evolving needs through capital projects and independent research and development for mid-to-long-term enhanced growth performance. Simultaneously, we plan to reward shareholders with continued dividend growth and meaningful increases to the scale and rate of our share repurchase program. Over the short-, mid-and long-term, we will strive to maximize cash flow per share dynamically, based on revenue growth opportunities, inorganic investments, and share repurchases to take full advantage of our significant cash flow generation and strong balance sheet."

Third-quarter 2021 net earnings include a non-cash pension settlement charge of $1.7 billion ($1.3 billion, or $4.72 per share, after-tax) related to the purchase of group annuity contracts to transfer $4.9 billion of gross pension obligations and related plan assets to an insurance company, and unrealized gains of $98 million ($74 million, or $0.27 per share, after-tax) due to increases in the fair value of investments held in the Lockheed Martin Ventures Fund.

The company expects 2022 net sales to decline from expected 2021 levels to approximately $66 billion and 2022 total business segment operating margin to be approximately 11.0%. Cash from operations in 2022 is expected to be greater than or equal to $8.4 billion, which excludes a potential decrease in 2022 cash from operations of up to $2.0 billion if the provisions in the Tax Cuts and Jobs Act of 2017 that eliminate the option to deduct research and development expenditures in the period incurred immediately and requires companies to amortize such expenditures over five years is not modified or repealed by Congress before it takes effect on Jan. 1, 2022. Although the company continues to have ongoing discussions with members of Congress, both on its own and with other industries through coalitions, it has no assurance that these provisions will be modified or repealed.